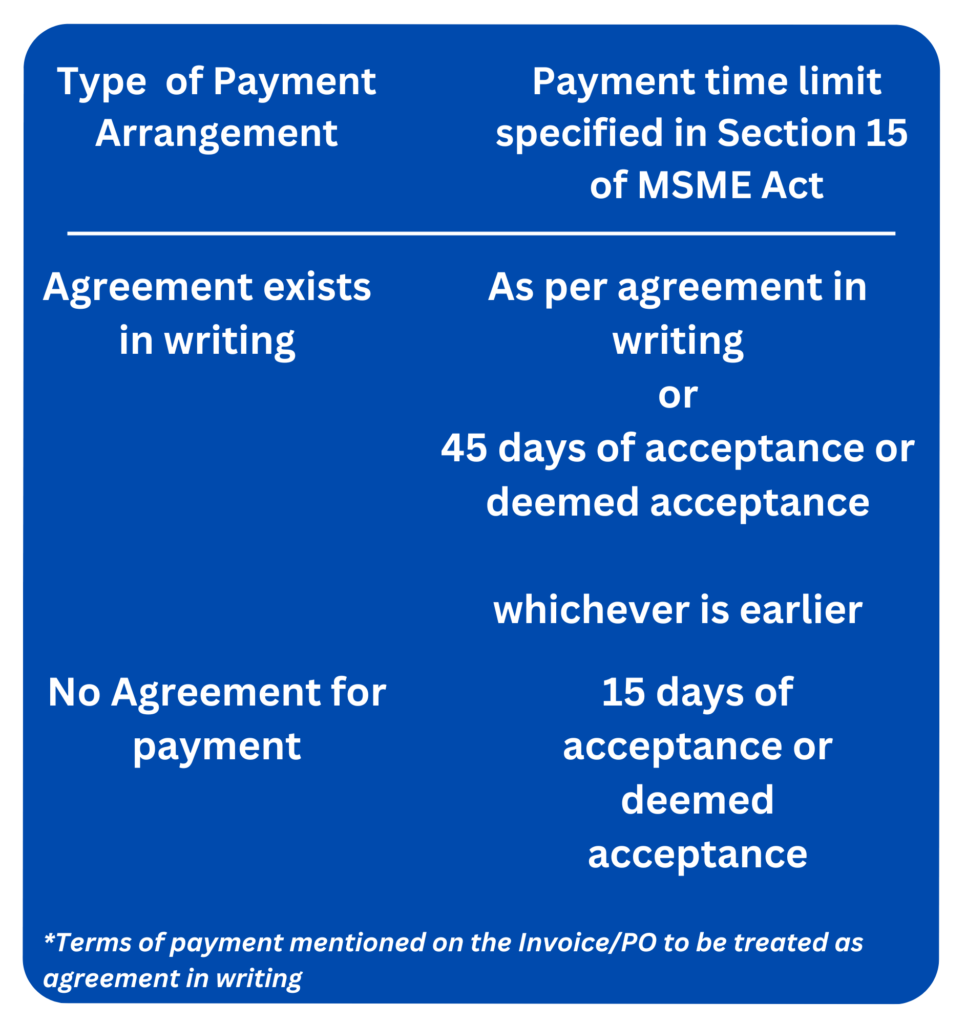

1. Time allowed as per section 15 of MSMED Act, 2006?

As per Section 15 of the MSMED Act, payments to micro and small enterprises must be made within the time specified in the written agreement, which cannot exceed 45 days. If there is no written agreement, the payments must be made within 15 days. Any payments made beyond these time limits are subject to conditions of the clause (h) in Section 43B, where deductions are allowed only on actual payment

2. To which entities does the section 43B(h) of the Income Tax Act,1961 applies?

Section applies to all those buyers who procures goods or services from the Micro or Small enterprises registered under MSMED Act,2006.

MSME registration status of buyers is irrelevant for application of section 43B(h). That means even if a buyer is not registered under MSME Act, but he procures goods and services from MSE, then section 43B(h) is applicable to such transaction.

3. What if supplier fails to intimate MSME registration to the buyer?

If the supplier doesn’t inform the buyer of MSME registration, no disallowance can occur under section 43B(h) due to absence of information.

4. Is section 43B(h) applicable to traders with MSME registration?

No, the section 43B(h) doesn’t apply to traders as the definition of enterprise under the MSMED Act excludes them.

5. Whether this amendment can be made applicable for an amount outstanding to micro and small enterprise as on 31/03/2023?

This amendment is made applicable from AY 2024-25 i.e. FY 2023-24. Hence, this amendment is not applicable for an amount outstanding to micro and small enterprises as of 31/03/2023. It will apply to the transactions from 1st April 2023.

6. Can disallowance be attracted under section 43B(h) for dues outstanding in relation to capital expenditure?

Capital expenditure is not an allowable expense under the Income Tax Act. Hence, no disallowance will be attracted under section 43B(h) for dues outstanding to capital expenditure.

7. What if only part payment is made by the buyer?

If part payment made by the buyer, then only remaining outstanding amount shall be disallowed.

8. Action points for buyers for FY 2024-25 in relation to section 43B(h):

- Maintain proper database of MSE suppliers to track the due dates for payments.

- Enter into a written agreement for payment terms.

- Make sure that no payment is outstanding at the year end which has exceed the time limit allowed under MSME Act.

- Send a confirmation letter to all suppliers seeking their MSE status.

9. Action points for buyers before 31st March 2024:

- Prepare a list of MSE suppliers from whom goods or services are procured from 1st April 2023 till 15th February 2024.

- Make sure that all payments outstanding to the MSE suppliers of above list, should be paid before 31st March 2024.

- Make sure that the goods or services procured from 15th February 2024 till 31st March 2024 are paid: either on or before 31st March 2024 or before the time allowed under MSME Act.

10. Action points for MSE Sellers:

- Inform the buyers about your MSE Status and share the MSE registration certificate with all the buyers.

- Quote your MSE registration number on all the Invoices

- Agree on payment terms with your buyers